louisiana estate tax return

1 have no impact on 2021 state income tax returns and payments due May 16. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

Louisiana Eviction Laws The Process Timeline In 2022

Where To Mail Louisiana State Tax Return.

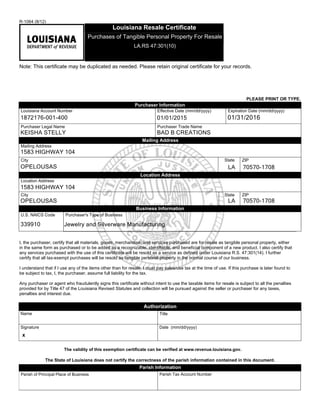

. You are required to have an LDR account number. Taxpayers can file their returns electronically through Louisiana File Online the states free web portal for individual tax filers. Individual Income Tax Resident Non-Resident Athlete Declaration of Estimated Income Taxes.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The initial amount was 112 million but it currently stands at 1206 million. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

This request does not grant an extension of time to pay the tax due. Individual Income Tax Resident Non-Resident Athlete Declaration of Estimated Income Taxes. Louisiana requires you to pay taxes if youre a resident or nonresident who receives income from a Louisiana source.

The amount of the state estate tax is equal to the federal estate tax credit allowed for state death taxes. Department of the Treasury Internal Revenue Service Austin TX 73301-0002. They can also submit their returns using commercially available tax preparation software or with printed state returns available at.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. By submitting an extension request you are requesting only an extension of time to file your Louisiana Fiduciary Income Tax return. Yes Louisiana imposes an estate transfer tax RS.

BATON ROUGE The filing and payment deadline for 2021 state individual income tax is Monday May 16. Generally the estate tax return is due nine months after the date of death. Fortunately only 1 or less of total households are required a file an estate tax return.

The state of Louisiana has lifted all state estate tax but you will have to remit some amount to the federal government as federal estate tax which is if you exceed the set amount. But everybody should be aware of the rules. Louisiana Citizens Insurance Tax Credit.

Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. The gift tax return is due on April 15th following the year in which the gift is made. Louisiana Department of Revenue Taxpayer Services Division P.

Louisiana does not levy an estate tax against its residents. School Readiness Tax Credits. 2 on the first 10000 of Louisiana taxable income.

If you are mailing a check for the Louisiana taxes due include the R-2868-V payment voucher along with your payment and mail to. Fiduciary Income Tax Who Must File. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Solved If you live in LOUISIANA. Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one.

Louisiana State Tax Return - I had my taxes done and was E-filed 4 weeks ago. 4 on the next 40000 of Louisiana taxable income. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceaseds net estate is 6000000 or more.

But just because Louisiana does not have an estate tax does not mean that the same is true for the federal government. TurboTax will compute Line 9 for. Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day.

How do I send my tax return by mail. Send to the Correct Address. The estate would then be given a federal tax credit for the amount of state estate taxes that were paid.

The state income tax rates for the 2021 tax year range from 20 to 60 and. Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must. State of Louisiana IT-540 Line 9 is your Federal Income Tax adjusted as follows.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. And you are filing a Form. Payments received after the return due date will be charged interest and late payment penalty.

Check the IRS website for where to mail your tax return. This service is available 24 hours a day. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

Ad Find Recommended Louisiana Tax Accountants Fast Free on Bark. And you ARE NOT ENCLOSING A PAYMENT then use this address. Everything you that you have entered for your Federal Return in TurboTax automatically flows through to your State of Louisiana return unless it is a State specific adjustment.

Original return Amended return Partial return Date of originalaaa Real estate Louisiana property only Stocks and bonds Mortgages notes and cash Insurance Other miscellaneous property. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Louisiana Department of Revenue PO.

473001 provides the tax to be assessed levied collected and paid upon the Louisiana taxable income of an estate or trust shall be computed at the following rates. These are addressed in the State questionnaires. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal Revenue Code.

Box 751 Baton Rouge LA 70821-0751.

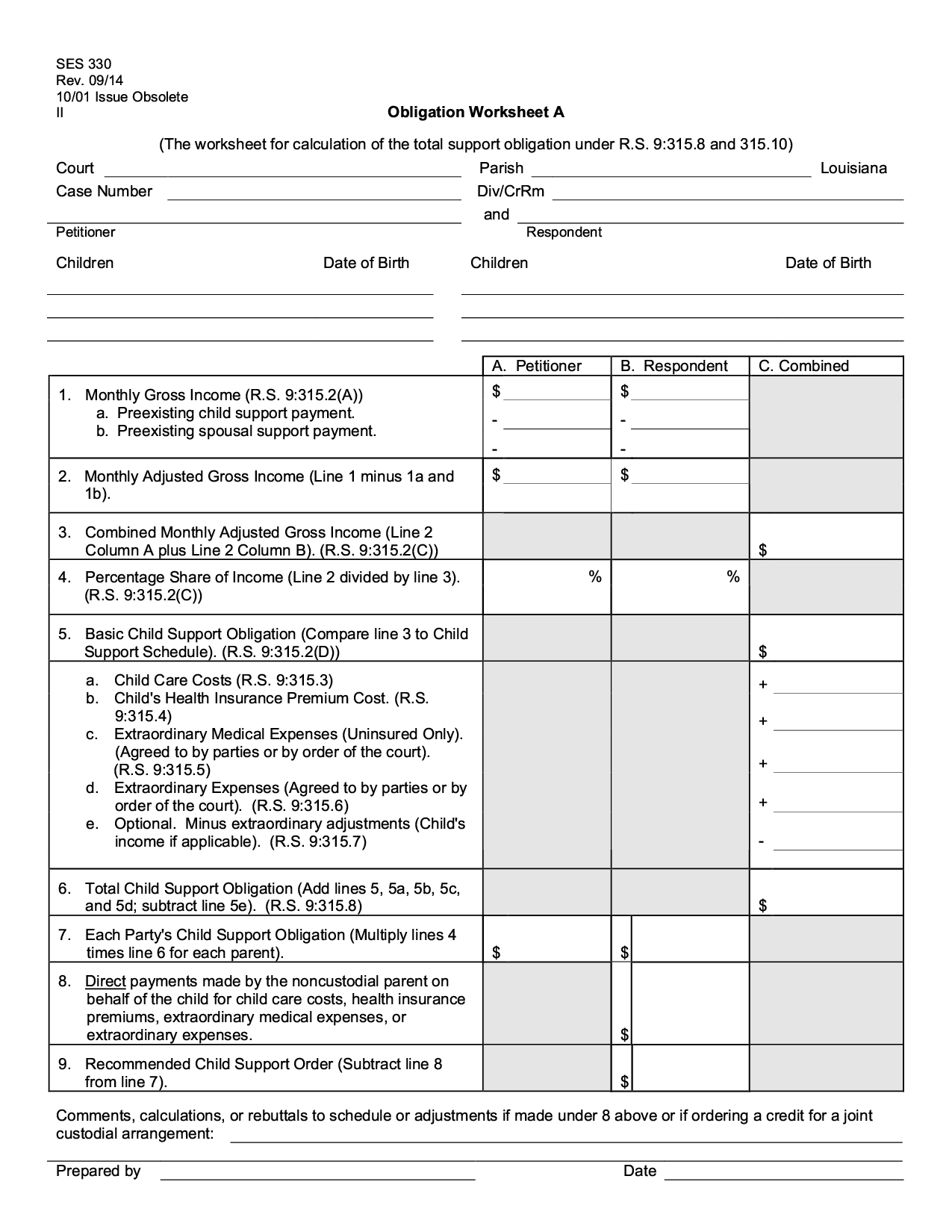

Louisiana Child Support Professional Thorpeforms

Louisiana Inheritance Laws What You Should Know Smartasset

Louisiana State 2022 Taxes Forbes Advisor

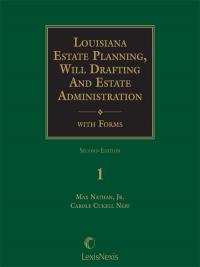

Louisiana Estate Planning Will Drafting And Estate Administration With Forms Lexisnexis Store

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Filing Louisiana State Tax Things To Know Credit Karma

Louisiana Income Tax Calculator Smartasset

2019 Legislative Session And Other Tax Updates Louisiana Law Blog

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Tax Deadline Extension And Relief For Winter Storm Victims The Turbotax Blog Tax Deadline Winter Storm Victims

The Value Of A Louisiana Succession Estate Scott Vicknair Law

Where S My Refund Louisiana H R Block

Silver Official Souvenir Ring From The 1904 Louisiana Purchase Exposition World S Fair Louisiana Purchase Louisiana

Louisiana Tax Id Online Application How To Apply For A Tax Id Ein Online Business Learning Center